Although this Thanksgiving might look different to most Americans, the sentiment of giving thanks for the blessings of the past year and the lessons we have learned is more important than ever. As we face the uncertain future, having peace of mind that your family will be taken care of should the unthinkable occur has become increasingly valuable.

Recent events have shed light on the fact that life is short, so let us take this opportunity to open the estate planning dialogue and give families the best possible plan to succeed.

Start the estate planning discussion

As your clients and their families come together to share Thanksgiving meals, encourage them to set aside time to discuss estate planning. A simple way to begin is by talking about where important papers and records are kept, and how to access them. Then, they can consider the following questions:

- Is there a will and is it up to date?

- Who will serve as the will’s executor?

- Who will serve as the financial power of attorney (POA)?

- How will we handle a long-term care situation?

- Who will serve as the medical POA?

While this discussion is an important starting point, it is likely that these questions will lead to a greater financial planning conversation that advisors can coordinate with their clients.

How to solve the biggest advisor pain points

Learn more

Crafting an estate planning strategy

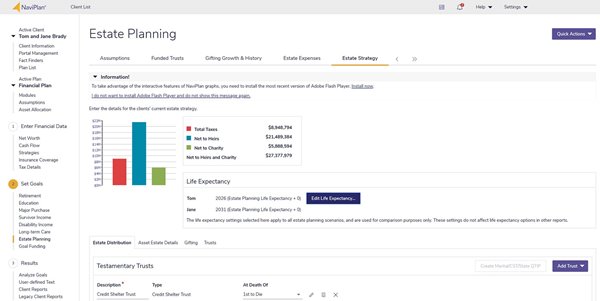

Once clients have a better understanding of how they want their wealth distributed, advisors can utilize NaviPlan to craft powerful estate strategies with each client’s unique needs in mind.

NaviPlan estate planning

While estate planning in NaviPlan, you and your clients can explore life expectancies, state death taxes, additional fees, and will information. NaviPlan also accounts for a variety of estate planning strategies including funded trusts, gifting, estate expenses, and more. As you work through these strategies, the estate coverage chart updates to allow your clients to see how to reach their estate goals.

NaviPlan client reports

NaviPlan is also equipped with client reports designed to support all their estate planning needs. The Estate Flowchart demonstrates how estate income is directed to charity and heirs, simplifying the explanation of a client’s estate scenario.

You can also give clients insight into how your proposed estate scenarios minimize tax liability with the Estate Planning Detailed Comparison. This client report offers a side-by-side breakdown of their current and proposed estate plans.

.png?width=414&height=396)

By having estate conversations well before the need to use these plans arises, clients can rest assured that their affairs are in order and that their families will not have to worry about finances when they should be coming together to support one another. As Thanksgiving approaches, consider reaching out to your clients to share the importance of estate planning and urge them to start the discussion and get on track to future success.

In this whitepaper, learn how FinTech can be implemented to solve the biggest pain points facing advisors in the areas of client engagement, advice delivery, and scaling advice complexity.