As vice president of financial planning, Tom is an integral contributor to the strategic vision around our financial planning initiatives. Additionally, he is critically involved in all partner interactions, thought leadership contributions, and internal training programs.

We at Advicent continue to be excited about sponsoring the Animal Spirits podcast hosted by Michael Batnick and Ben Carlson. For the listeners that may not be familiar with Advicent, we are the provider of NaviPlan – an industry-leading financial planning solution trusted by over 140,000 financial professionals across over 3,000 firms worldwide. This includes four of the top five custodians, 15 of the top 25 broker-dealers, seven of the top 10 North American banks, and seven of the top 10 North American insurance firms.

This week’s episode discusses some of the challenges faced by investors when managing a household budget. Listen to this week's episode below:

In the following sections, I will touch on how NaviPlan is equipped to handle some of the strategies discussed by Michael and Ben during this episode. To see the process for yourself, check out the video below:

Long-term expense trends

There are many great options available today for personal financial management (PFM). While offerings such as Mint.com are great for tracking short-term expenses and categorizing purchases, your trends today are going to look far different than they will in five years. These will especially be true during the retirement phase of your life.

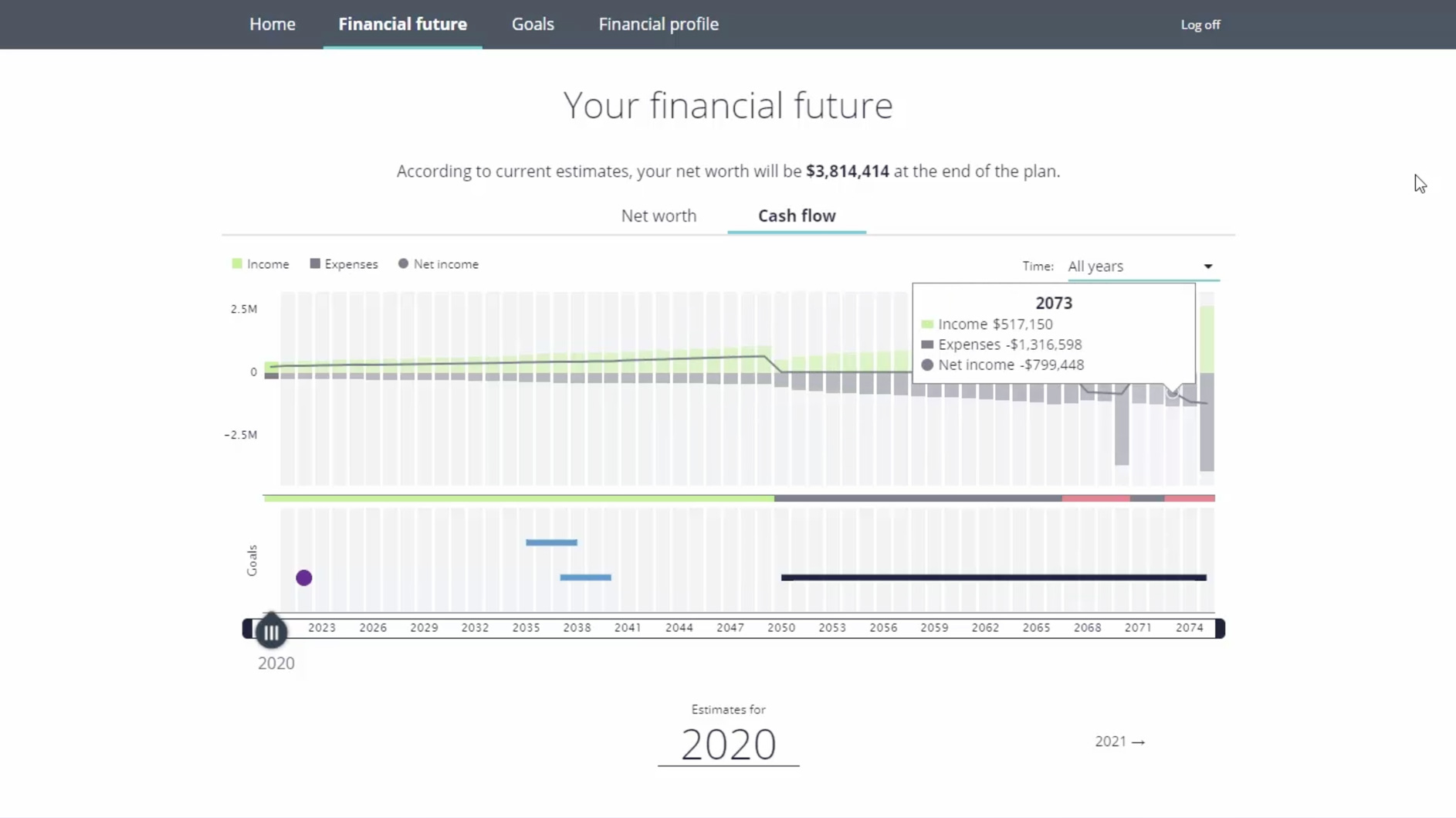

The NaviPlan client portal is an excellent offering that gives investors access to these long-term cash flow projections. Within the portal, clients can view their future cash flows and net worth through engaging visuals.

Remotely connect with clients and deliver engaging advice.

Learn more

Cash flow analysis

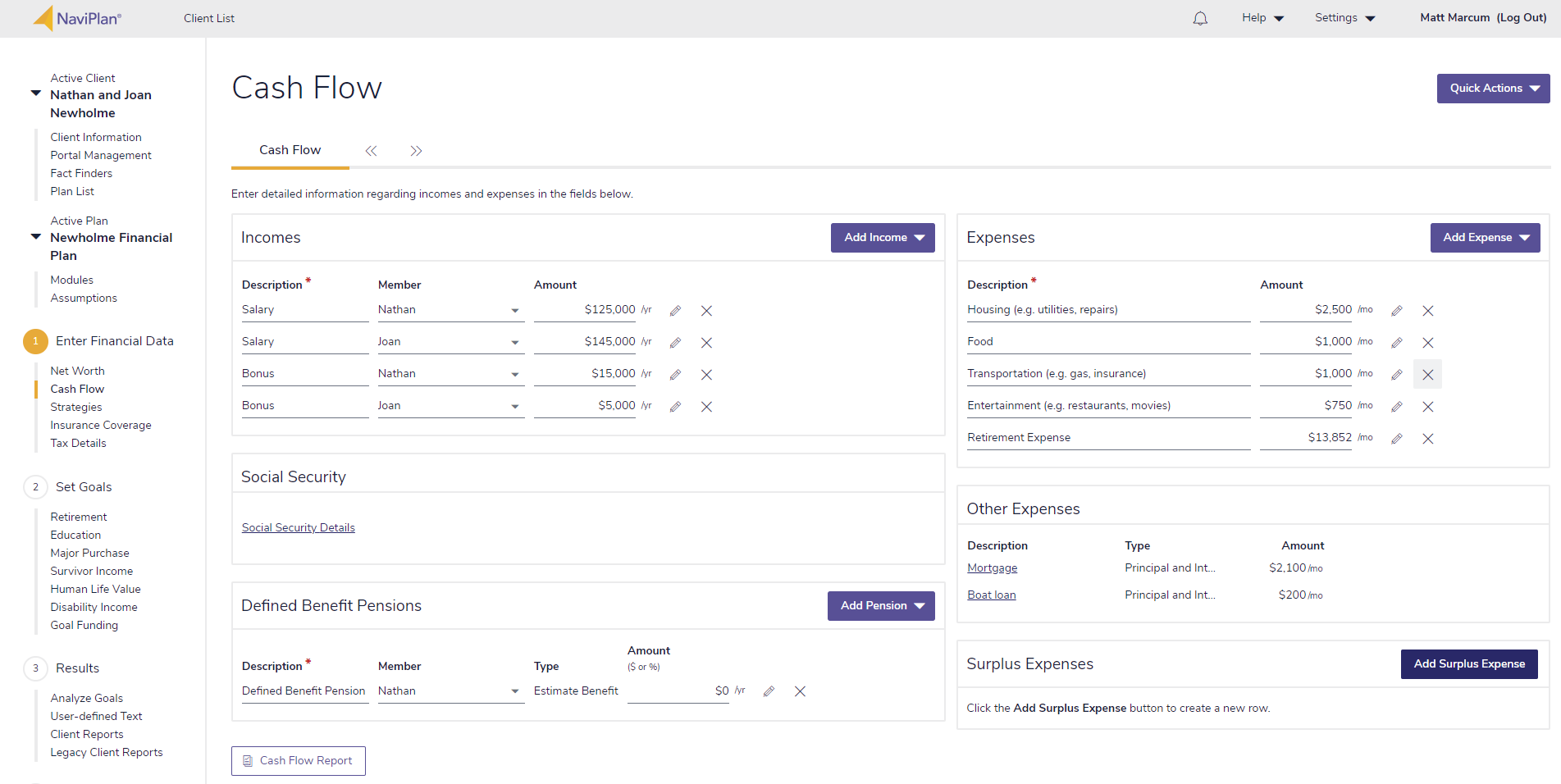

Every financial plan begins with a set of goals, but when combined with the precise cash flow analysis capabilities of NaviPlan, results are brought to a greater level of precision.

Cash flow analysis also equips advisors with the ability to efficiently scale their advice to the evolving needs of their clients. This enables advisors to deliver quality advice to every demographic, ranging from pre-retirement budgeting and debt paydown strategies all the way up to complex high-net-worth estate and tax analysis.

Subscribe to the Animal Spirits podcast:

Spotify, Apple Podcasts

In this whitepaper, learn how FinTech can be implemented to solve the biggest pain points facing advisors in the areas of client engagement, advice delivery, and scaling advice complexity.