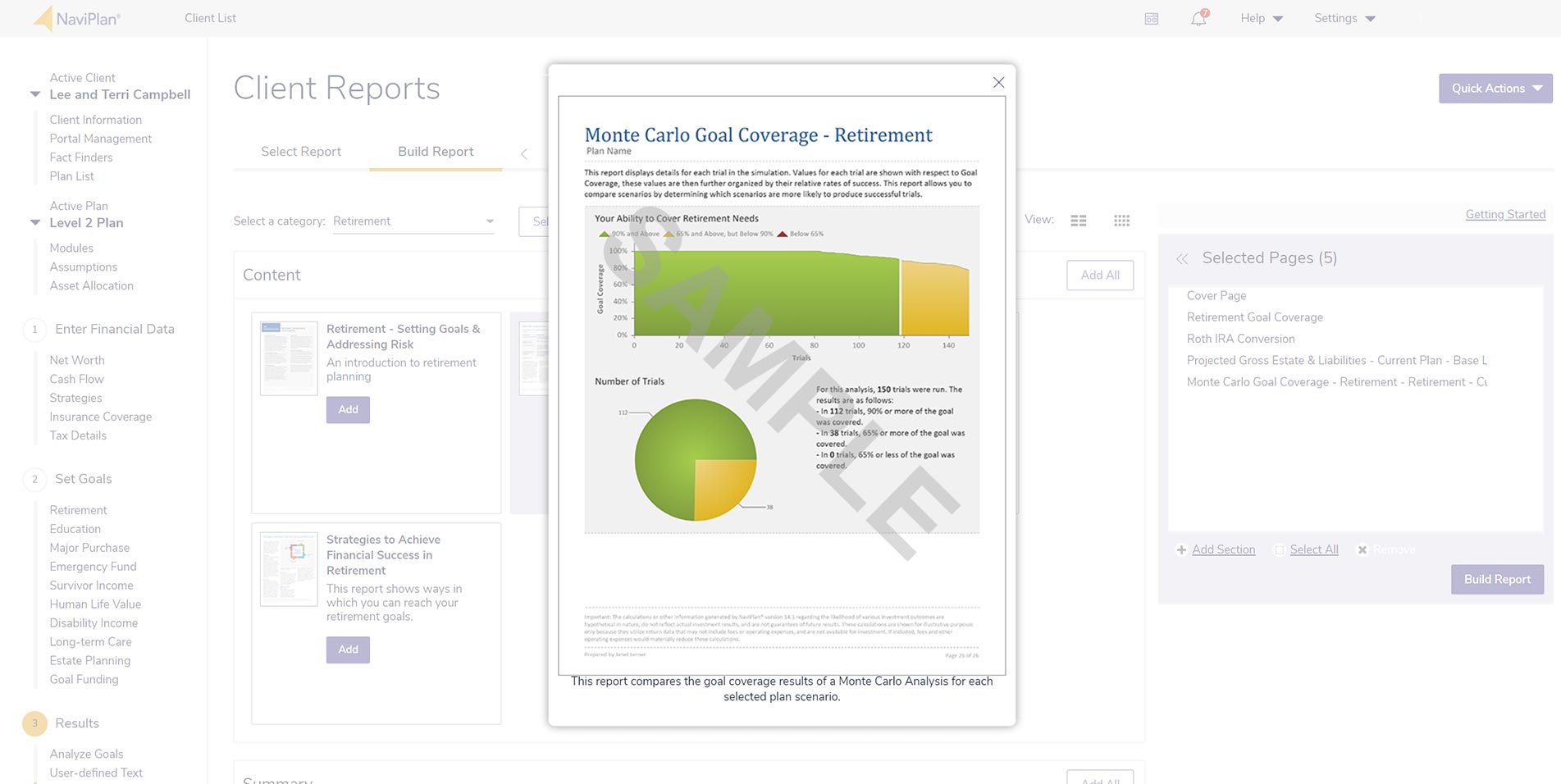

Quickly audit advice

Using Monte Carlo sensitivity analysis within NaviPlan, advisors can add variability to their plans to test their advice against market volatility and longevity risks. Use Monte Carlo retirement simulators to experiment with: Portfolio size, portfolio allocation, sub-portfolios, annual income to be withdrawn, annual deposits, inflation, time horizon, risk profiles, and more.

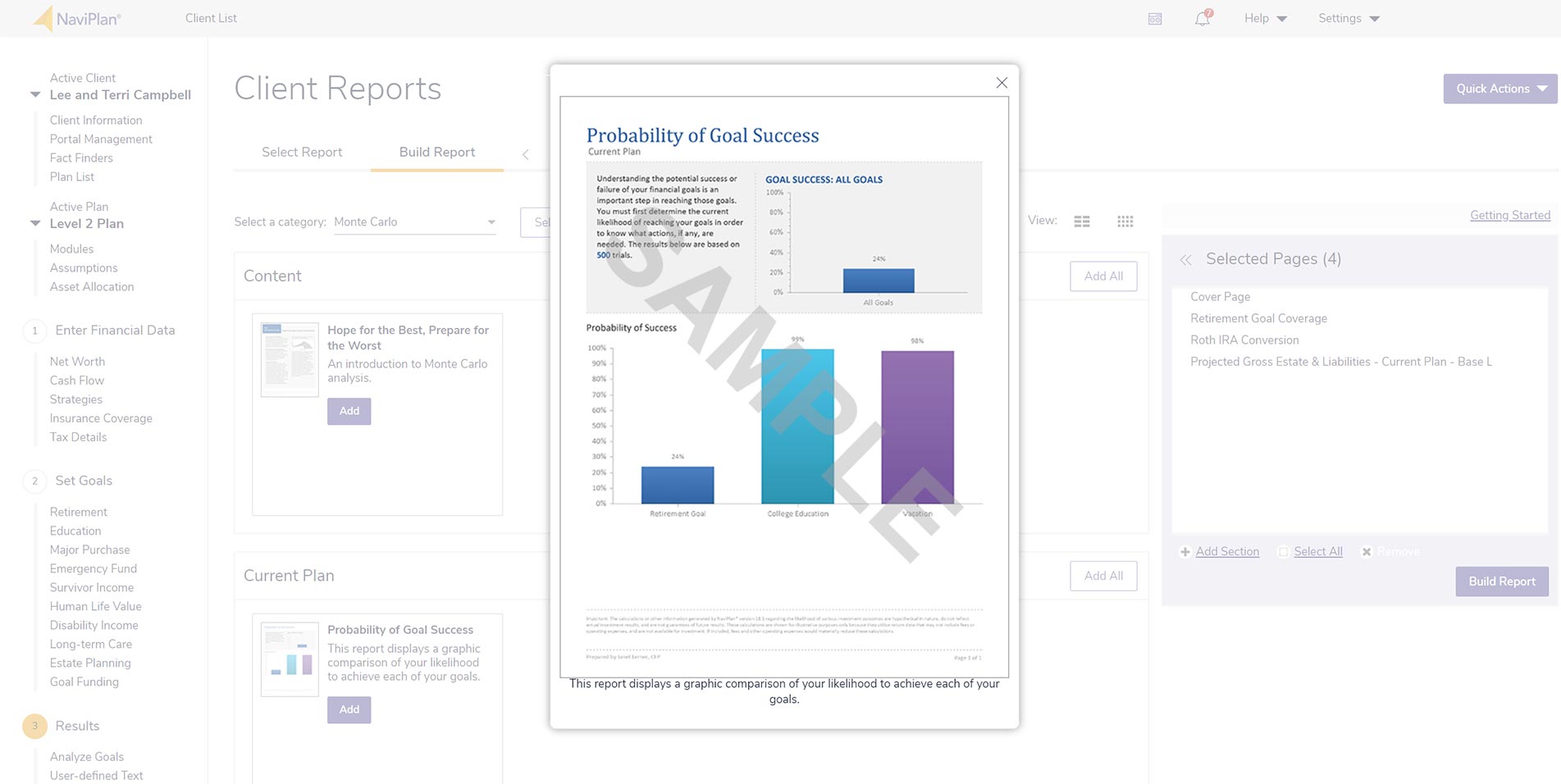

Separate goal testing

As a cash flow based financial planning tool, NaviPlan allows advisors to test success rates of individual goals or the entire plan.