Scale advice alongside needs

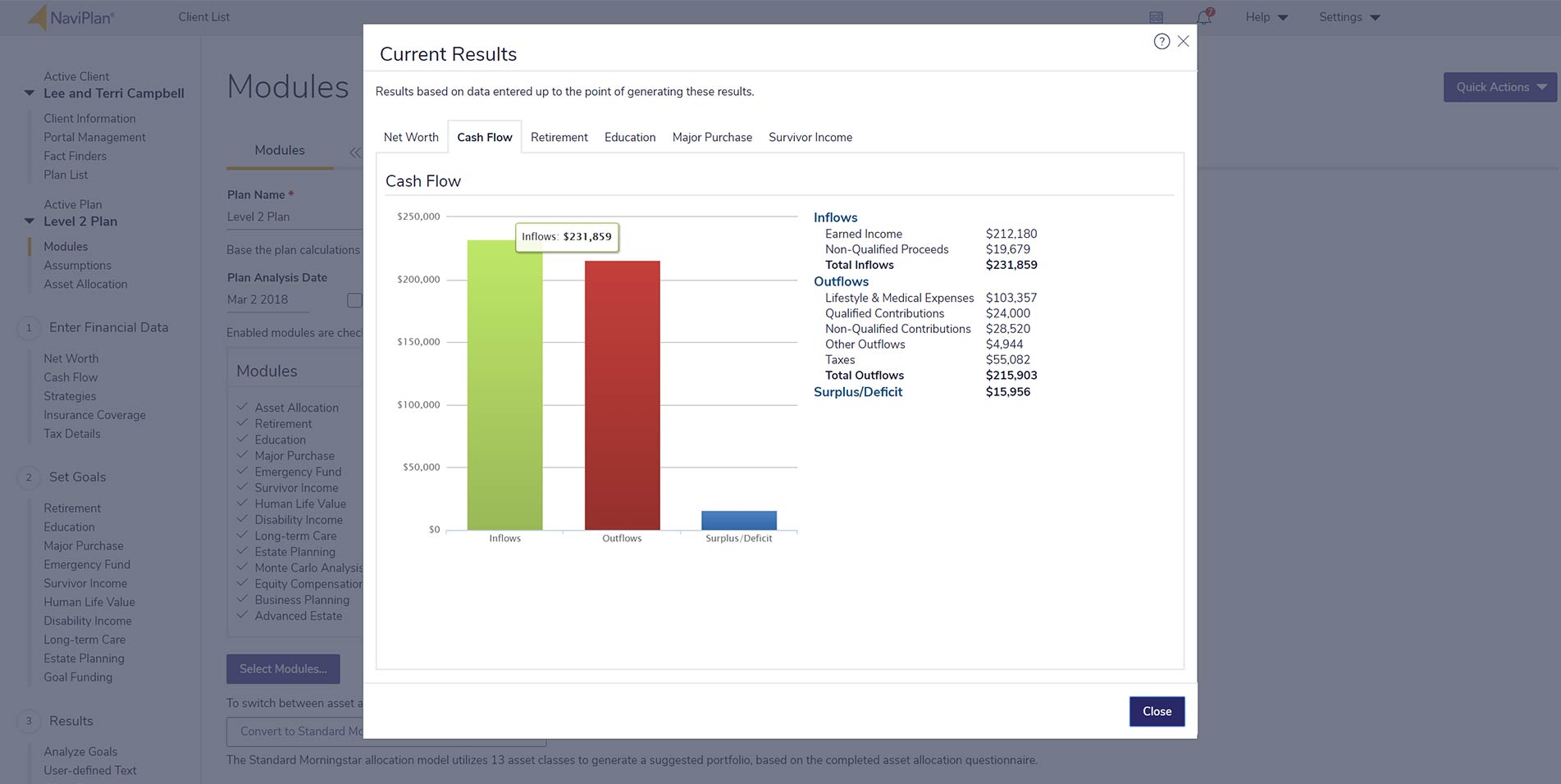

Client needs vary widely. Though some clients may only need a simple plan, there are few who would not benefit from cash flow analysis. Cash flow analysis enables advisors to deliver quality advice to every demographic, ranging from pre-retirement budgeting and debt paydown strategies all the way up to complex high-net-worth estate and tax analysis.

Expedite data entry

Benefitting from the accuracy of cash flow planning no longer requires long hours of data entry as account aggregation and other digital tools can the expedite the process to a matter of minutes. NaviPlan financial planning software lets you spend more time focusing on delivering quality financial advice and less time on data entry.

Increase client engagements

Whereas a goals-based financial plan can lead to infrequent meetings and potential for inaccuracy as a client’s situation evolves, cash flow planning encourages more regular client engagements. This not only leads to a far more accurate plan in the long-term but opens the door for additional selling opportunities with increased client conversations.

Related resources for financial advisors

Learn how to cater to the unique needs of business owners with the power of NaviPlan.